Monday, April 13, 2020

8:00 a.m.

COVID-19 Monday Morning Brief

Brought to you by

The San Antonio Hispanic Chamber of Commerce

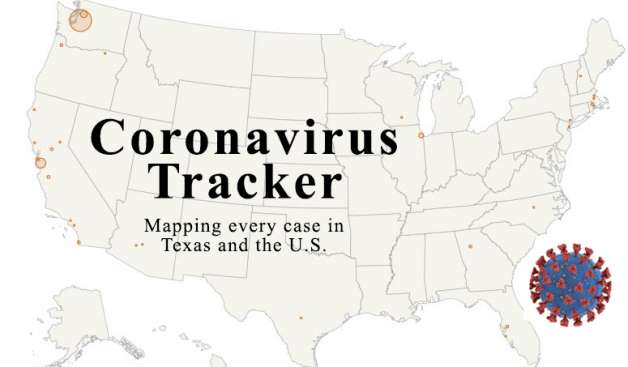

| U.S. | Texas | Bexar County | |

| Total Cases | 561,103 | 13,484 | 772 |

| Total Deaths | 22.106 | 271 | 27 |

MONDAY MORNING OBSERVATION – The Minority Report:

It’s now 21 days into the Mayor’s Work Safe Order and 18 days until it is set to expire on April 30. It is not clear if the order will be extended so continue to plan for the worst and hope for the best during this rapidly changing environment. This means small business owners should be razor-focused on more stimulus legislation coming from Washington, D.C. and plugged into how quickly San Antonio government officials move to a comprehensive economic recovery plan that starts with those most impacted.

As easy as it sounds, it is already proving to be messy, difficult and taxing, so it is important to be patient, diligent and unrelenting. As the data becomes more and more available, we are quickly learning who are the most impacted. Coming from the country’s oldest Hispanic chamber in the country, we noticed several in-depth media articles to help prioritize a few observations towards San Antonio’s recovery worth sharing.

The Numbers:

A growing and grim drumbeat of reports revealed that COVID-19 is devastating many minority communities with news that Blacks and/or Hispanics in the United States are twice as likely to die from COVID-19. Hispanics died from COVID-19 at a rate of 22 per 100,000, according to New York City, which was the first to release racial data; Black people, which comprise 32% of Louisiana’s population, represent a startling 70% of the coronavirus deaths according to new data also released this past week.

The impacted demographic is one part of the recovery equation and their correlating economic personification of the impacted small and micro business community is proving to be the other part of the recovery equation as the data further suggests. Lending Tree and Balboa Capital released independent survey results of COVID-19 on small businesses through the first week of April 2020 with staggering findings. Using this data to glean for the Alamo City’s small business community, there are many harsh takeaways:

Balboa Capital Survey

- 88 percent of small businesses are being impacted.

- 78 percent of small business owners have incurred additional out-of-pocket expenses.

- 66 percent of small business owners are not moving forward with their Q2 investment plans.

- Six in 10 small business owners said their supply chain has been affected.

- Most critical needs:

- 74 percent of small business owners said they need access to capital, i.e. loans

- 16 percent said tax deadline extensions

- 8 percent said employer tax credits

- 54 percent of small business owners said some (or all) of their employees are working from home.

Lending Tree Survey

- 71 percent of small business owners are worried they will never recoup the losses because of COVID-19

- 47 percent of small business owners have taken on debt to keep their business afloat during the pandemic

- An additional 34 percent attempted to seek financing but were not approved

- Small business owners have turned to the following funding options:

- 39 percent have taken on credit card debt

- 17 percent have taken out a business loan

- 12 percent have taken out a personal loan

- 12 percent have taken on another type of debt

- 8 in 10 small business owners have “no idea” where to get emergency funding for their business right now (Note: SAHCC can help with this)

- 69 percent of small business owners do not have enough cash on hand to run their business for the next 90 days

- 49 percent of small business owners had temporarily closed their business

- About 70 percent of small business owners adjusted their workforce to cope with the pandemic:

- 37 percent laid off employees

- 43 percent reduced hours for employees

- 12 percent implemented pay cuts for employees

- 57 percent of small business owners expect to lose at least half of their revenue in the next 90 days

- 36 percent anticipate losing more than 75 percent of revenue.

Also, a separate northeast U.S. analysis by Economic Innovation Group shows that the disruption is being driven largely by two anchor industries (important in San Antonio as well): real estate and retail – including food services like restaurants and bars, as well as arts and entertainment, output has fallen by three-quarters. Though national surveys, this data paints a very rough and tough picture for San Antonio’s small and minority-owned businesses.

The Money

When I mentioned keeping an eye on Washington, D.C, I meant it. A little more than half of the $350 billion designated for the small business loan program has been committed in the week since lenders began accepting applications. About 587,000 applications had been processed totaling more than $151 billion from more than 4,100 lending institutions, according to the Small Business Administration and reported in the WSJ.

Even Claire Kramer Mills, assistant vice president at the New York Fed, issued a statement saying that small businesses nationwide now face unprecedented challenges as the country grapples with the significant economic and social effects of the COVID-19 pandemic. This was reported in a U.S. News and World Report Money article titled, Small U.S. Businesses Were Already Struggling. Then Coronavirus Hit because many small businesses were struggling with funding shortfalls and financial challenges even before the coronavirus pandemic hit, leaving them with little cash on hand to weather the slowdown caused by the virus. Because many small firms, particularly the smallest businesses and those owned by black and Hispanic entrepreneurs, also lack traditional banking relationships, this has made it more difficult for them to receive financial assistance during this crisis according to the statement released by the Federal Reserve and sounding the alarm.

To help provide some further perspective and delve deeper on this and more, we’ve arranged an exclusive SAHCC COVID-19 WEBINAR:

How to Help:

Sustaining San Antonio’s Economy: The CARES Act and Future Legislation

Presented by Signal Group and Wiley Rein LLP via Washington, D.C.

Tomorrow, Tuesday, April 14th, 2020

3:00 p.m. CST

Join us as this D.C. government-relations firm and law practice discuss the legislative landscape for small businesses, trade associations and non-profit organizations. We will also answer some of your most pressing questions about the changing landscape and governing politics with some of the country’s top experts and insiders.

The Time:

In addition to following the money, I’ve also stressed the timeline to recovery because it is a tremendous variable in this small business recovery equation. How much money is being lost, over what time, results in the amount of pressure your business can withstand. With about 3 more weeks of the Work Safe Order in place, I spoke with a several members about this who shared the following practical advice at this point:

5. “Make my voice heard about what is happening and not happening on Capitol Hill, the state House, County Commissioners Court and City Hall.”

4. “Be more resourceful, work my COVID-19 business angles, get my budget super tight, work with my employees needs and get through this.”

3. “Take care of the business items and organizational needs that will me help re-open in the new normal.”

2. “I am going to contingency plan, disaster plan and recovery plan for next time.”

1. “I’m working my existing business relationships, lining up new business leads and pressing the pedal to metal.”

This is an extremely dire situation for small businesses and an absolute worse-case, perfect storm if you’re a minority smaller or micro business by reading the data. It means as small business owners, there are fewer options, and the plight is that much more difficult. It means the struggle to access financial relief will be a killer and time will not be friendly, and it means that your SAHCC is here to help now more than ever to steer the fiscal recovery to those who need it most in San Antonio.

The COVID-19 Monday Morning Brief is a product of the San Antonio Hispanic Chamber of Commerce and brought to you by Leonard B. Rodriguez, former White House Adviser to the President of the United States during 9-11 and Political Director for the Governor of New York, to keep you briefed on critical business-related focus areas during this pandemic.

An entrepreneur and Hispanic Business Magazine 100 Influential alum; he is also the award-winning author of Celebrating Outstanding Hispanics – 500 Years of Latino Pride and a 10th generation San Antonian. He currently serves as the Senior Vice President at the San Antonio Hispanic Chamber of Commerce in the Office of Small Business Programs and Services and served his prior position as the President and CEO of the City of San Antonio Westside Development Corporation.

He can be reached at leonardr@sahcc.org